The FCA said it wanted to remind banks they should provide support to struggling borrowers tailored to their specific circumstances and only charge fees which were fair and that covered costs

Britain’s Financial Conduct Authority (FCA) said on Thursday it was writing to more than 3,500 lenders to demand greater support for consumers struggling with soaring costs of living, after uncovering ‘serious failings’ at more than 30 credit providers.

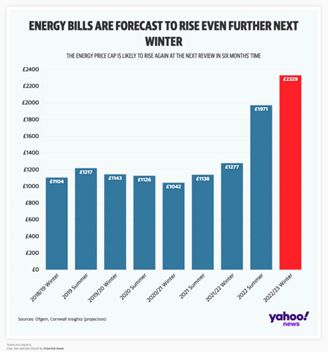

The watchdog said it was concerned that some vulnerable customers were not receiving the guidance or advice they needed to navigate challenges in managing their finances, against a backdrop of high inflation and fuel insecurity.

Many consumers are feeling the impact of the rising cost of living in their personal finances and we expect this to increase over the next few months. Early action is important for those struggling with debt, Sheldon Mills, Executive Director of Consumers and Competition at the FCA, said.

The regulator said it wanted to remind banks they should provide support to struggling borrowers tailored to their specific circumstances and only charge fees which were fair and that covered costs.

While it said it had found evidence of banks and lenders offering appropriate standards of support, serious failings were found at 34 firms, largely operating in the consumer credit sector, the FCA said, adding that it expects these firms to make improvements in how customers are treated.

Although not all ‘Buy Now Pay Later’ (BNPL) products are currently regulated, the letter was also sent to BNPL providers to encourage good standards of customer care and support.

The FCA said its review of the sector included four surveys of over 400 lending firms, consumer research and more detailed assessments of a sample of 63 firms.

It said it would monitor outcomes and carefully scrutinise firms, and would use supervisory and enforcement powers to take further action as necessary.

The financial services industry has a significant role in helping consumers manage their finances – and it should expect us to pay close attention to how they do that over the next few months, Mills said.

Leave a Reply